How the Fed’s Timing Affects Your Wallet

TL;DR:

If you are a Buyer or Seller in Austin’s high-end market, the Federal Reserve’s next move on interest rates directly affects your bottom line. Even a small rate change can mean thousands of dollars in monthly payments on a high six- or seven-figure Mortgage. Understanding this timing gives you an advantage whether you are upgrading, downsizing, or planning your next move.

What the Fed Means for Austin Real Estate

Right now, the Federal Reserve’s rate policy is one of the biggest forces shaping Austin’s real estate market. When the Fed keeps rates higher for longer, borrowing becomes more expensive, and that influences everything from Buyer behavior to Seller strategy in neighborhoods like Westlake, Northwest Hills, and Travis Heights.

As a move-up Buyer, you may be pausing right now, waiting for Mortgage rates to ease. As a Seller, you may be noticing fewer showings or more cautious Buyers. Both sides are feeling the effects of elevated borrowing costs.

When rates stay high:

- Monthly payments on luxury homes remain inflated

- Jumbo Loan borrowers, meaning loans above roughly $766,550 in Travis County, face stricter lending standards from Mortgage Lenders

- Buyer demand softens, especially in the $1 million to $2.5 million range

- Sellers experience longer days on market and fewer competing offers

The Fed is keeping rates elevated to slow inflation, but that also slows real estate activity. Once the Fed signals that it is ready to begin lowering rates, the market will begin to shift. Buyers regain purchasing power, and Sellers benefit from renewed demand.

When rates begin to fall:

- Monthly Mortgage payments decline on high six- and seven-figure loans

- Refinancing becomes appealing again for existing homeowners

- Buyers can afford more home within the same monthly payment

- Sellers see increased traffic, stronger offers, and quicker sales

The Power of a Quarter Point

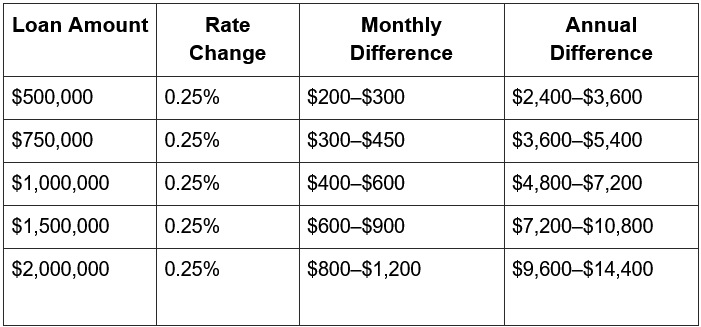

Even a small move in rates can have a significant impact. Every 0.25 percent change in Mortgage rates equals roughly $40 to $60 per month per $100,000 borrowed. Let’s look at how that affects Austin’s most common high-end loan amounts.

That difference represents real buying power. For many Austin Buyers, even a quarter-point shift can open opportunities in areas like Travis Heights, Northwest Hills, or Westlake that might have been just out of reach at current rates.

Austin Market Snapshot

Austin’s luxury market has remained resilient, although higher borrowing costs have slowed overall activity. Median prices in established neighborhoods such as Westlake, Northwest Hills, and Travis Heights remain strong, while inventory has increased slightly. This gives qualified Buyers more leverage today, but that window will narrow when rates begin to fall.

If rates begin to ease in 2025, expect renewed competition for premium homes around Central and West Austin, including lake-adjacent properties and hillside estates. Sellers who prepare early and price strategically will be positioned to capture serious Buyers reentering the market once Mortgage Lenders begin offering more competitive terms.

The Real Problem and the Solution

The real challenge in today’s market is not just high rates. It is uncertainty. Many Austin Buyers and Sellers are waiting for the perfect moment, but by the time the Fed officially announces cuts, the most prepared clients will already be under contract. The key is to position yourself now so you can act quickly when the opportunity arrives.

Bottom Line

The Fed’s timing directly influences your purchasing power, your home’s marketability, and your long-term financial plan. The smartest move is to start preparing now or within the next 12 months.

If you are considering buying or selling in Austin, I will connect you with a trusted Mortgage Lending Strategist who can model different rate scenarios and help you prepare to move with confidence when the market shifts.

Categories

- All Blogs (108)

- Active Listings (1)

- Austin Homeownership (1)

- Austin Neighborhoods (16)

- Buyers (25)

- Economic Insights (1)

- Fun Fact (2)

- Homebuyer Strategy (2)

- Investing (10)

- LIATX (42)

- Market Insights (5)

- Market Updates (7)

- Million Dollar Listing (1)

- Mortgage Strategy (2)

- Off-Market (1)

- Open House (1)

- Personal (1)

- Real Estate (24)

- Real Estate News (1)

- Sellers (16)

- Seniors (4)

- Things To Do (2)

- Tips & Tricks (3)

Recent Posts

GET IN TOUCH