Could Capital Gains Taxes on Home Sales Disappear? Here’s What It Means for Austin Homeowners

What If You Could Sell Your Home and Keep Every Dollar of Profit?

That’s what President Trump floated this week. The White House is considering eliminating capital gains taxes on primary home sales.

Right now, you’re taxed if you profit more than $250,000 as a single seller or $500,000 if you are married. That might sound high, but in a city like Austin, home values have jumped so much that even everyday sellers are crossing the threshold.

Home Values Are Up. Tax Breaks Have Not Changed.

In 1997, the median home price was about $145,000. Now it’s close to $417,000. But those capital gains thresholds have stayed exactly the same.

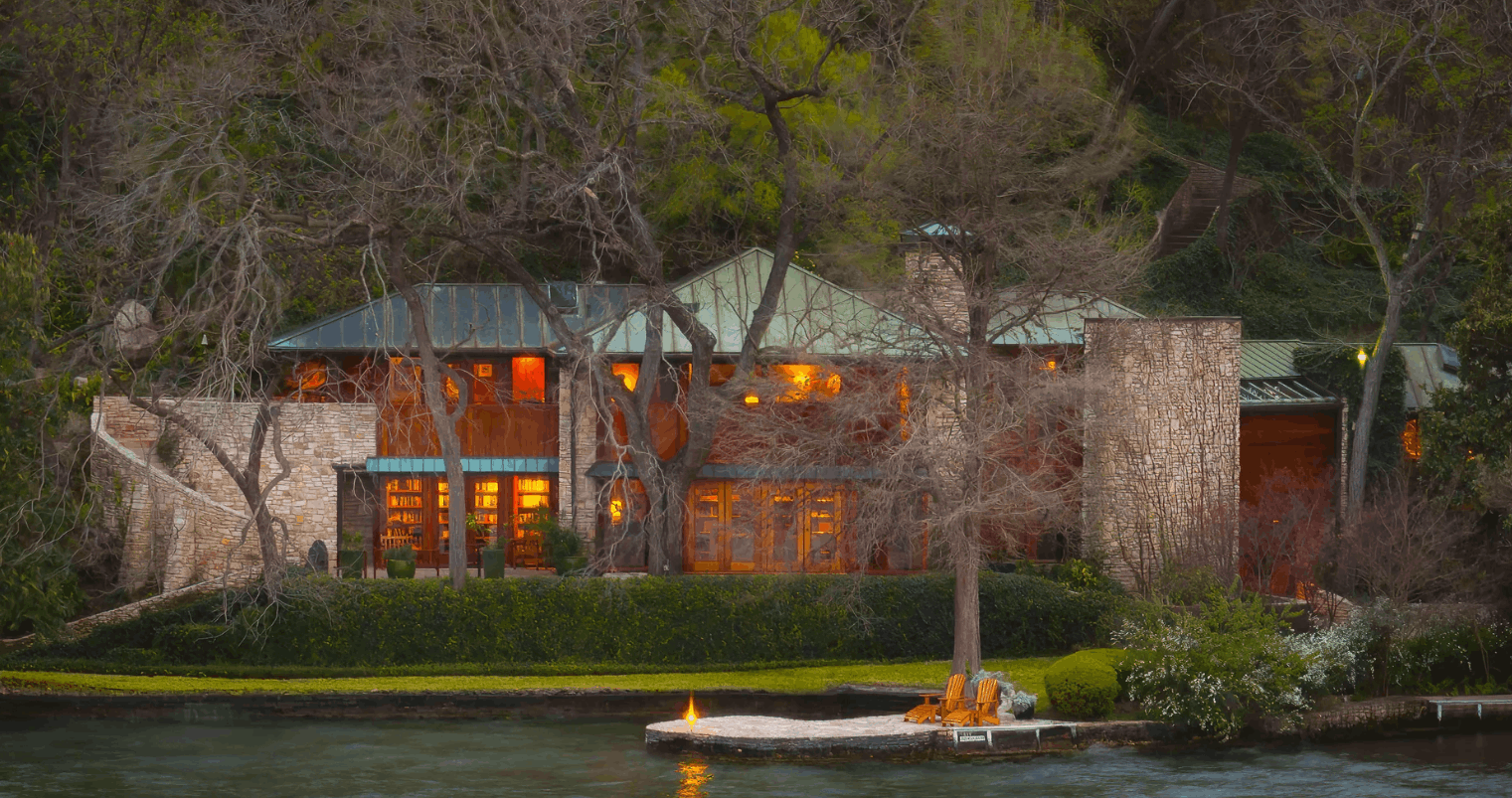

That means people who have lived in the same house for years, especially in Westlake, Bee Cave, or Northwest Hills, are now getting hit with unexpected taxes. They are not necessarily wealthy. They just happened to buy early.

A 2025 study by the National Association of Realtors found that 34 percent of U.S. homeowners could exceed the $250,000 limit. That is millions of people affected by a tax rule that has not kept up with real life.

What Washington Is Talking About Now

President Trump said the Fed should have lowered rates sooner but added that cutting capital gains taxes would boost the housing market. Representative Marjorie Taylor Greene introduced a bill that would eliminate those taxes entirely for primary home sales.

Most tax experts believe a full repeal is unlikely. However, raising the threshold seems possible and could have a huge impact for sellers in hot markets like Austin.

What Austin Homeowners Should Do Right Now

If you are thinking about selling to downsize, relocate, or just cash out, this matters. Even the possibility of change could affect how and when you sell.

You worked hard to build that equity. Now is the time to protect it.

Let’s talk strategy. I’ll give you the honest scoop about what’s happening with taxes and timing in your zip code.

Text me anytime. I’m here to make sure you are always a step ahead.

Photo credit: amydeane

Categories

- All Blogs (108)

- Active Listings (1)

- Austin Homeownership (1)

- Austin Neighborhoods (16)

- Buyers (25)

- Economic Insights (1)

- Fun Fact (2)

- Homebuyer Strategy (2)

- Investing (10)

- LIATX (42)

- Market Insights (5)

- Market Updates (7)

- Million Dollar Listing (1)

- Mortgage Strategy (2)

- Off-Market (1)

- Open House (1)

- Personal (1)

- Real Estate (24)

- Real Estate News (1)

- Sellers (16)

- Seniors (4)

- Things To Do (2)

- Tips & Tricks (3)

Recent Posts

GET IN TOUCH